Building wealth is a long-term game. Whether you’re just starting out in your 20s, establishing yourself in your 30s, or looking to solidify financial independence in the years beyond, having the right strategies at each stage of life can set you on the path to financial success. In this blog, we’ll explore key strategies to build wealth as you progress through different life stages, with practical steps you can take today.

In Your 20s: Laying the Financial Foundation

Your 20s are a time of exploration, learning, and growth. While this decade might feel too early to focus on wealth-building, the habits you develop now can make a huge difference in your future financial health. The key is to start small, but start early.

1. Focus on Education and Skill Development

Before you can earn significant money, you need to invest in yourself. This is the time to focus on building a strong career foundation. Whether it’s through formal education, online courses, or self-directed learning, building valuable skills that are in demand will lead to greater earning potential in the future.

Examples:

- Take courses in finance, tech, marketing, or other high-demand industries.

- Develop soft skills like communication, leadership, and time management.

2. Start Budgeting and Saving

It’s never too early to start budgeting. Tracking your income and expenses helps you understand where your money is going and how much you can save. Set aside at least 20% of your income for savings and emergency funds.

Tips:

- Use apps like Mint, YNAB, or PocketGuard to manage your budget.

- Create an emergency fund with 3-6 months’ worth of expenses.

3. Get Comfortable with Investing

Your 20s offer a huge advantage: time. The earlier you invest, the more time your money has to grow due to the power of compound interest. You don’t need to invest large amounts; even small, consistent contributions can grow substantially over time.

Strategies:

- Start with index funds or ETFs for diversified, low-risk investments.

- Open a Roth IRA or 401(k) if available through your employer.

- Consider robo-advisors like Betterment or Wealthfront to manage small investments.

4. Avoid Bad Debt

Student loans, credit cards, and other forms of debt can quickly pile up. Focus on paying off high-interest debt as quickly as possible, and avoid taking on new debt that isn’t tied to investments in your future (e.g., education or real estate).

In Your 30s: Building Momentum

Your 30s are typically when career paths solidify, and many people start to increase their earnings. This decade is about taking the foundations you built in your 20s and scaling them up, setting the stage for long-term financial security.

1. Maximize Your Income

By your 30s, you should have a clear understanding of your career path. This is the time to push for salary increases, negotiate better benefits, or even pivot into higher-paying fields if necessary. Don’t be afraid to ask for a raise if you’ve been consistently performing well.

Steps:

- Research salary benchmarks in your industry.

- Improve your negotiation skills to ask for promotions or higher-paying roles.

- Consider additional certifications or degrees to enhance your earning potential.

2. Grow Your Investments

If you’ve been consistently investing in your 20s, your 30s are the time to step it up. Increase your contributions to retirement accounts, and start thinking about diversifying your portfolio with different asset classes like real estate or bonds.

Investment Tips:

- Aim to save at least 15% of your income for retirement.

- Diversify into stocks, bonds, and possibly real estate or peer-to-peer lending.

- Look into real estate investment trusts (REITs) if buying property isn’t an option.

3. Prioritize Financial Protection

As you start accumulating wealth, it’s important to protect it. This means ensuring you have the right insurance (health, life, disability) and planning for the unexpected. Life is unpredictable, and having financial protection will ensure your wealth-building isn’t derailed by an emergency.

Steps:

- Get adequate health insurance and consider life and disability insurance.

- Create or update your will, and think about estate planning.

- Ensure you have a robust emergency fund to cover any unexpected expenses.

4. Manage Lifestyle Inflation

One of the biggest traps people fall into in their 30s is lifestyle inflation — the tendency to spend more as you earn more. It’s tempting to upgrade to a bigger house, a fancier car, or more luxurious vacations, but if you’re not careful, this can eat away at the wealth you’re trying to build.

Tips:

- Keep housing and transportation costs reasonable relative to your income.

- Prioritize experiences and relationships over material possessions.

- Avoid keeping up with the Joneses — focus on your own financial goals.

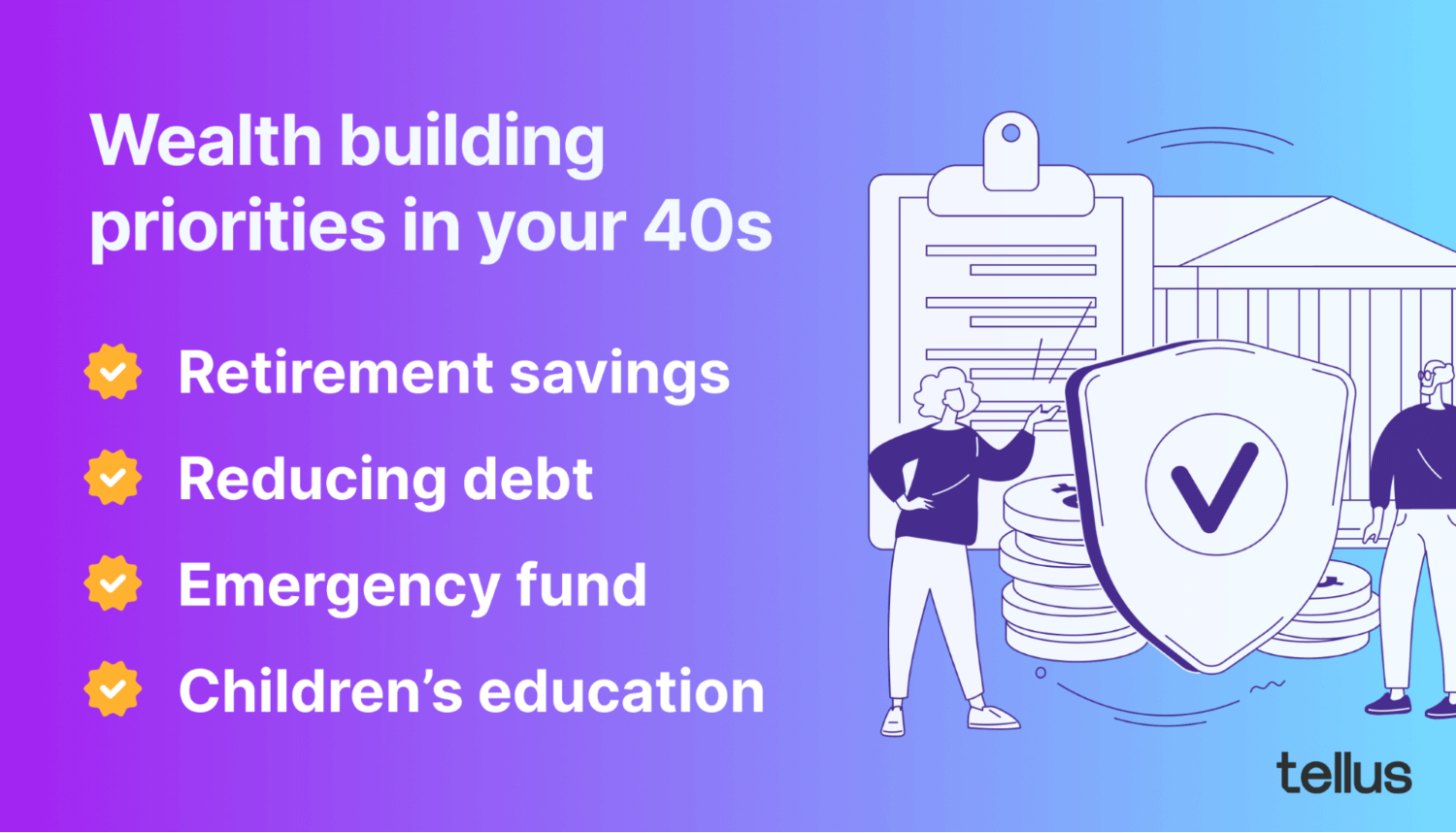

In Your 40s and Beyond: Securing Your Financial Independence

By your 40s, your wealth-building efforts should be in full swing. This is the decade when you focus on solidifying your financial independence and preparing for the future, whether that’s early retirement or supporting your family’s needs.

1. Focus on Aggressive Savings and Investment

Your 40s are typically your peak earning years, which means it’s time to save and invest more aggressively. If you’ve been contributing regularly to your retirement accounts, consider maxing out contributions to 401(k)s or IRAs. If you haven’t started, now’s the time to catch up.

Strategies:

- Maximize your 401(k) or IRA contributions, especially if you’re behind.

- Rebalance your portfolio to reduce risk as you get closer to retirement.

- Continue to diversify — consider rental properties or alternative investments.

2. Plan for Retirement

It’s never too early to think about retirement, but by your 40s, you should be actively planning for it. This includes calculating how much you’ll need to retire comfortably and making sure your current investments align with those goals.

Steps:

- Use retirement calculators to estimate your future financial needs.

- Consider consulting a financial advisor to fine-tune your retirement strategy.

- Start thinking about your desired lifestyle in retirement — will you downsize, travel, or continue working part-time?

3. Prioritize Debt Elimination

If you still have debt — whether it’s a mortgage, car loan, or personal loans — make paying it off a top priority. Debt-free living will give you more flexibility and security as you approach retirement.

Debt Elimination Tips:

- Focus on paying off your mortgage before retirement.

- Pay off any lingering student loans or credit card debt.

4. Estate Planning and Leaving a Legacy

By your 40s and beyond, it’s also time to start thinking about what legacy you want to leave behind. This includes estate planning, creating trusts, or making charitable contributions that align with your values.

Steps:

- Create or update a will, and consider setting up a trust for your heirs.

- Discuss estate planning with a legal advisor to ensure your wealth is distributed according to your wishes.

The Journey of Wealth-Building

Regardless of where you are on your financial journey, the key is consistency. With the right mindset and strategies, you can set yourself up for financial success at any age.